Turkin kiinteistöjen hintatrendit 2025 — lyhyt katsaus 🏙️📈

Turkin asuntomarkkinat ovat edelleen dynaamiset vuonna 2025 – nimellishintakehitys on vahvaa, mutta reaalituotto inflaation jälkeen on vaihtelevaa. Kotimainen kysyntä vauhdittaa myyntiä, kun taas ulkomaiset ostot hiljenevät. Tässä kattavassa katsauksessa Turkin kiinteistöjen hintatrendit 2025 puramme uusimmat hintaluvut, kaupunkitason erot, keskeiset markkinatekijät ja tarjoamme toimivia ohjeita ostajille, sijoittajille ja myyjille – kaavioiden ja selkeän suunnitelman avulla siitä, miten Ideal Estates voi auttaa sinua hyödyntämään oikeat tilaisuudet.

Miksi tämä on tärkeää (lyhyt katsaus)

- Todellisten ostajien on tiedettävä nimellis- ja reaalihintakehitys.

- Sijoittajat tarvitsevat kaupunkitason hinta- ja tuottovertailuja mahdollisuuksien arvioimiseksi.

- Ostajat tarvitsevat käytännön toimia rahoituksen ja oikeudellisen suojan varmistamiseksi ostaessaan Turkissa.

Turkin kiinteistöjen hintatrendit 2025 keskeiset pääkohdat (yhdellä silmäyksellä) ✔️

- Kansallinen keskihinta (Q2 2025): 39 697 TRY / m2 (USD 1,025).

- Istanbul on edelleen kallein: 63 125 TRY / m2 (USD 1,630).

- Ankarassa on nopein kaupungin kasvu (Q2 2025 vuositasolla ~33,6 %).

- Nimellishintojen kasvu on edelleen reaalisesti inflaation jäljessä monilla markkinoilla.

Q2 2025 kaupunkien hintataulukko – yhdellä silmäyksellä (TRY ja USD/m2)

Alla on tiivis taulukko, joka esittää yhteenvedon vuoden 2025 toisen neljänneksen keskimääräisestä asuntojen neliöhinnasta ja Turkin tärkeimpien markkinoiden vuotuinen muutos. (Tiedot vuoden 2025 toiselta neljännekseltä, keskuspankki ja markkina-analyysi).

| Kaupunki | TRY / m2 (Q2 2025) | USD / m2 (Q2 2025) | Vuosi-% (vuoden 2025 toinen neljännes vs. vuoden 2024 toinen neljännes) |

|---|---|---|---|

| Istanbul | 63,125 | 1,630 | 28.83% |

| Ankara | 35,690 | 922 | 33.58% |

| İzmir | 43,970 | 1,135 | 19.50% |

| Antalya | 46,395 | 1,198 | 22.88% |

| Bursa | 32,669 | 844 | 25.24% |

| Mersin | 30,783 | 795 | 18.28% |

| Muğla | 79,077 | 2,042 | 9.72% |

| Koko maassa | 39,697 | 1,025 | 22.40% |

Lähde: Turkin tasavallan keskuspankki / markkinaraportti (Q2 2025).

(Voit myös tarkastella tätä artikkelia varten luotua interaktiivista taulukkoa ja kaaviota, joka visualisoi näitä kaupunkien hintatasoja.)

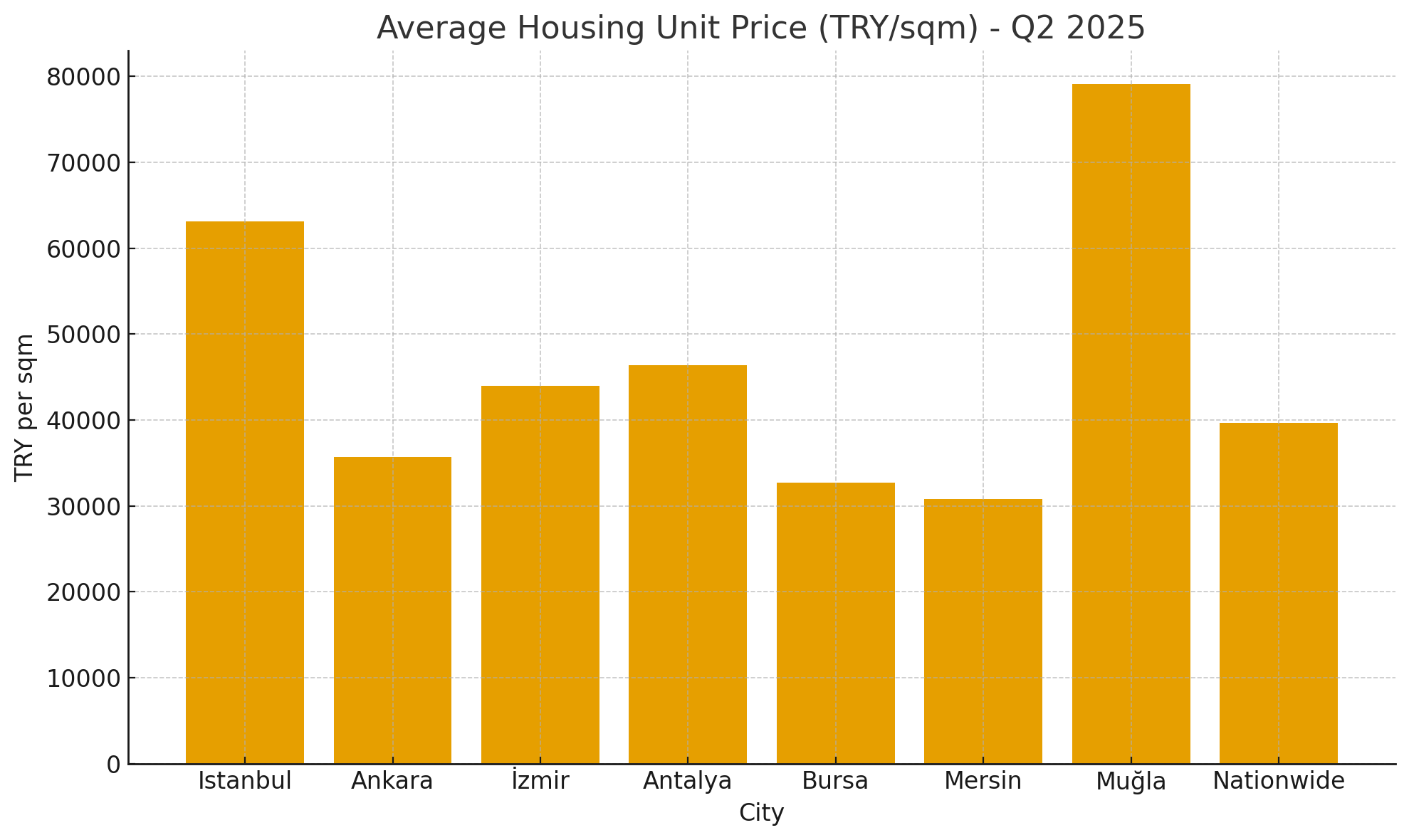

Visuaalinen tilannekuva — kaavio ja tulkinta 📊

(Näytetty kaavio: Asuntojen keskimääräinen yksikköhinta (TRY/m2) – Q2 2025)

Mitä kaavio näyttää

- Rannikkoalueiden vapaa-ajanvietto- ja loma-alueet (esim. Muğla) ovat hintataulukon kärjessä rajoitetun tarjonnan ja luksuskysynnän vuoksi (korkean hintaluokan kotimaiset ja ulkomaiset ostajat).

- Istanbul johtaa suurten kaupunkimarkkinoiden joukossa, mikä heijastaa parhaiden sijaintien niukkuutta ja vahvaa pitkän aikavälin kysyntää.

- Sisä- ja teollisuuskaupungit (esim. Mersin, Bursa) osoittavat alhaisempia hintatasoja, mutta houkuttelevia tuottoja sijoitus-vuokrausstrategioille.

Sijoittajan huomio: Käytä neliöhintaa + paikallisia vuokratuotto- ja kysyntätekijät parhaiden riskipainotettujen nousumahdollisuuksien tunnistamiseksi.

Syvempi katsaus — Nimellinen kasvu vs. reaalituotot 🔍

- Nimellishinnat nousevat edelleen monilla markkinoilla, mutta Turkin korkea inflaatio tarkoittaa, että reaalihintojen nousu on usein negatiivinen tai tasainen inflaatiokorjauksen jälkeen. Keskuspankin asuntohintaindeksi (RPPI) nousi heinäkuussa 2025 noin 32,8 % vuodentakaiseen verrattuna, mutta tämä tarkoitti lievää reaalista laskua, kun inflaatio otetaan huomioon.

- Ankara oli yksi harvoista suurista kaupungeista, joilla oli positiivista reaalikasvua tarkastelujaksolla.

Mitä tämä tarkoittaa

- Lyhytaikaiset sijoittajat, jotka keskittyvät vain nimellisiin voittoihin, voivat joutua harhaan. Reaalituotot (inflaation ja kustannusten jälkeen) määräävät ostovoiman ja sijoitusten onnistumisen.

- Valuuttariski on ulkomaalaisille tärkeä — Turkin liiran heikkeneminen tai vahvistuminen vaikuttaa USD/EUR-tuloksiin.

Kysynnän tekijät — kuka ostaa ja miksi 🧭

- Kotimaiset ostajat: viimeaikaisen myyntivauhdin pääasiallinen voima. Kysyntä on ollut vahvaa ensisijaisissa asunnoissa ja muuttoasunnoissa.

- Ulkomaiset ostajat: kiinnostus on laantunut edellisvuosiin verrattuna, mutta keskittyy edelleen rannikko- ja luksuskiinteistöihin Istanbulissa.

- Turistivetoiset markkinat: Antalya ja Muğla houkuttelevat edelleen loma-asuntojen ostamista ja lyhytaikaisten vuokrausten kiinnostusta.

Keskeiset vaikuttajat

- Infrastruktuurihankkeet ja liikenneyhteydet (uudet metrolinjat, moottoritiet) nostavat arvoja lähiöissä ja työmatkavyöhykkeillä.

- Kaavoitus ja maan niukkuus nostavat hintoja merenranta- ja historiallisilla alueilla.

Vuokramarkkinat ja tuotot – lyhyesti 🏘️

- Vuokratuotot vaihtelevat kaupungin ja segmentin mukaan – Istanbulin kaupunkiasunnot voivat tarjota alhaisemmat bruttotuotot, mutta suuremman arvonnousupotentiaalin; pienemmät kaupungit tai kasvavat työmatkakaupungit voivat tuottaa vahvempia välittömiä tuottoja.

- Tasapainoisen analyysin tulisi sisältää bruttotuotto, odotettu vajaakäyttö, hallinnointikustannukset ja mahdolliset verovaikutukset.

Käytännön ostoehdotuksia kansainvälisille sijoittajille 🇹🇷✍️

- Omistustodistukset (Tapu): varmista, että kiinteistöt ovat puhtaat; tee yhteistyötä paikallisen notaarin ja hyvämaineisen asianajajan kanssa.

- Valuuttastrategia: ota huomioon TRY:n volatiliteetti; hintaneuvottelut ja sopimusvaluutta (TRY vs. ulkomaan valuutta) ovat tärkeitä.

- Rahoitus: asuntolainojen saatavuus ja korot vaihtelevat – jotkut ulkomaiset ostajat käyttävät käteistä tai ulkomaista rahoitusta välttääkseen paikallisen korkoriskin.

- Verot ja maksut: siirtoverot, notaari- ja välityspalkkiot – sisällytä nämä hankintamenoon.

Missä ovat mahdollisuudet? (lista) 🚩

- Istanbulin ympäristössä kehittyvät työmatkaliikennekäytävät: infrastruktuurivetoinen kasvu (metro-/rautatieyhteydet).

- Ankaran keskihintaiset asunnot: vahva vuosikasvu viittaa kohtuuhintaisuuteen ja vauhtiin.

- Muğla ja Antalya (luksusrannikko): korkeat hinnat, mutta varakkaiden ostajien ja loma-asuntojen kysyntä on jatkuvaa.

- Toissijaiset kaupungit (Bursa, Mersin): parempi välitön tuottopotentiaali; sopii tuottohakuisille sijoittajille.

Riskien tarkistuslista – mitä kannattaa seurata ⚠️

- Inflaatio- ja rahapolitiikan muutokset (vaikuttavat reaalituottoihin).

- Valuuttakurssien vaihtelut vaikuttavat ulkomaisten ostajien tuottoihin.

- Sääntely- tai veromuutokset vaikuttavat ulkomaiseen omistukseen.

- Ylitarjonta tietyillä kehityspainotteisilla alueilla.

Kuinka Ideal Estates auttaa sinua navigoimaan Turkin markkinoilla — (Miksi tehdä yhteistyötä kanssamme) 🤝🏡

1. Paikallinen markkinatieto ja dataan perustuva neuvonta

Ideal Estates käyttää ajantasaisia markkinaraportteja (mukaan lukien keskuspankin indeksit ja paikalliset kysyntä- ja tarjontamittarit) mallintaakseen sekä nimellis- että reaalituottoja harkitsemillesi kiinteistöille. Käännämme asuntokompleksien tietojoukot käytännöllisiksi osto-/pidä-/myy-ohjeiksi, jotka on räätälöity tavoitteidesi mukaan.

2. Räätälöity kiinteistöjen hankinta ja tarkastus

Rajaamme strategiaasi (tuotto, pääoman kasvu, loma-asuntojen vuokraus) vastaavat naapurustot ja tarkistamme laki-/omistusoikeushistorian, rakennusmääräystenmukaisuuden ja realistisen vuokrakysynnän.

3. Kokonaisvaltainen tapahtumien hallinta

Neuvotteluista kaupan päättämiseen ja myynnin jälkeiseen vuokraukseen/kiinteistönhallintaan Ideal Estates koordinoi paikallisia asianajajia, notaareja, kääntäjiä ja veroneuvojia — vähentäen kitkaa ja suojaten sijoitustasi.

4. Valuutta- ja veroneuvonta

Autamme jäsentämään tarjouksia valuuttalausekkeilla, yhdistämme sinut erikoistuneisiin veroneuvojiin ja esittelemme verojen jälkeisiä tuottoskenaarioita, jotta piilokulut eivät yllätä sinua.

5. Salkkutason ajattelu

Jos sijoitat hajautusta tai passiivista tuloa varten, mallinnamme salkut (useita kiinteistöjä, sijainteja, hintaluokkia) kassavirran, riskin ja pitkän aikavälin arvonnousun optimoimiseksi.

Miksi valita Ideal Estates — lyhyt lista

- Laaja paikallinen verkosto varmennettuja rakennuttajia ja myyjiä.

- Läpinäkyvät palkkiot ja raportointi.

- Sijoittajapalvelut: vuokrahallinta, jälleenmyynnin ajoitus ja exit-suunnittelu.

- Kokemusta kansainvälisten asiakkaiden kanssa: viisumi-/oleskelu- ja kansalaisuussääntöjen navigointi sijoituskohtaisesti tarvittaessa.

Toimenpidestrategia: 3 esimerkkisijoitusstrategiaa (skenaarioita) 🎯

A — Pääoman kasvu (5–7 vuoden horisontti)

- Kohde: Istanbulin prime-plus-kaupunginosat tai Antalyan kasvukäytävät.

- Lähestymistapa: valitse hyvin sijaitsevia, vastavalmistuneita tai lähes valmistuneita projekteja; keskity alueisiin, joilla on merkittäviä infrastruktuuritöitä.

- Riski: korkeampi neliöhinta; alhaisempi välitön tuotto.

- Ideal Estatesin rooli: hankinta-, neuvottelu- ja irtautumisajoitusneuvonta.

B — Tuotto ja kassavirta (3–5 vuoden horisontti)

- Kohde: Bursa, Mersin, suurten metropolialueiden lähiötTarget: Bursa, Mersin, commuter suburbs of large metros.

- Lähestymistapa: keskihintaiset asunnot liikenneyhteyksien lähellä; bruttotuoton optimointi etusijalla.

- Riski: maltillinen pääoman kasvu; hallittavissa oleva vajaakäyttö.

- Ideal Estatesin rooli: tuottomallinnus ja kiinteistönhallinta.

C — Sesonki-/loma-asunnot (lyhyt tai keskipitkä aikaväli)

- Kohde: Muğla, Antalya (rannikkolomakohteet).

- Lähestymistapa: huvilat/asunnot tunnetusti tunnetuilla matkailullisilla mikromarkkinoilla, joilla on vahva käyttöaste.

- Riski: kausiluonteisuus ja hallinnoinnin intensiteetti.

- Ideal Estatesin rooli: vuokraustoiminta, varausten optimointi, paikallinen ylläpito.

Tyypillinen aikataulu ja ostajien tarkistuslista (tiivis) 🗂️

- Määrittele strategia ja budjetti.

- Valitse kohteet (tarjoamme 3–5) dataan perustuvine vertailuineen.

- Näytöt / virtuaalikierrokset.

- Lakisääteiset tarkastukset ja Tapu-vahvistus.

- Tarjousneuvottelut ja sopimus.

- Kaupan päättäminen — notaari, verot, siirto.

- Myynnin jälkeinen hallinta (vuokra, ylläpito, jälleenmyynnin suunnittelu).

Usein kysytyt kysymykset koskien Turkin kiinteistöjen hintatrendit 2025 ❓❓❓

K1: Odotetaanko Turkin kiinteistöjen hintojen nousevan edelleen vuonna 2026?

V: Näkymät ennustavat nimellisen nousun jatkuvan monissa segmenteissä, mutta reaalikasvu riippuu inflaatiosta ja makrotaloudellisesta politiikasta. Alueelliset erot säilyvät — tutustu ajantasaisiin indekseihin.

K2: Mikä Turkin kaupunki antaa parhaan vuokratuoton?

V: Tuottoprosentit vaihtelevat mikromarkkinoiden mukaan. Toissijaiset kaupungit ja lähikaupungit osoittavat usein korkeampia bruttotuottoja kuin Istanbulin keskusta, mutta tekijät, kuten vajaakäyttö ja hallinnointikustannukset, vaikuttavat nettotuottoihin.

K3: Voivatko ulkomaalaiset ostaa kiinteistöjä Turkissa?

V: Kyllä — ulkomaalaiset voivat ostaa kiinteistöjä tiettyjen alueellisten rajoitusten mukaisesti (esim. sotilasalueet) Ideal Estates koordinoi lakisääteisiä tarkastuksia ja varmistaa vaatimustenmukaisuuden.

K4: Miten inflaatio vaikuttaa kiinteistösijoitukseeni Turkissa?

V: Korkea inflaatio voi nostaa nimellishintoja, mutta reaalituotot (ostovoima) voivat laskea. Harkitse tuloja tuottavia kiinteistöjä tai suojauksia suojautuaksesi inflaatiolta, joka syö reaalituottoja.

K5: Kuinka paljon käsirahaa tyypillisesti vaaditaan ostamiseen?

V: Käsiraha ja maksuaikataulut vaihtelevat rakennuttajan ja myyjän mukaan. Ennakkomarkkinointi kohteissa porrastetut maksut ovat yleisiä. Myös ulkomaalaisten asuntolainojen saatavuus vaihtelee – Ideal Estates voi yhdistää sinut paikallisiin lainanantajiin ja tarjota ennusteita.

Turkin asuntomarkkinat vuonna 2025 tarjoavat monia mahdollisuuksia: kaupunkien pääoman kasvua, rannikkoalueiden luksuskysyntää ja tuottoystävällisiä jälkimarkkinoita. Avain on dataan perustuva strategia, joka ottaa huomioon nimellis- ja reaalituotot, valuuttariskin ja paikalliset lait. Ideal Estates tuo paikallisen tietämyksen, transaktioasiantuntemuksen ja myynnin jälkeiset palvelut muuntaakseen markkinatiedot tuloksiksi.

Rakennamme yhdessä Turkin strategiasi 🚀

Oletko valmis tutkimaan Turkin kiinteistömarkkinoita paikallisen kumppanin kanssa? Ota yhteyttä Ideal Estatesiin saadaksesi ilmaisen sijoitusneuvonnan, joka on räätälöity sinun tavoitteisiin – mukaan lukien kaupunkikohtainen hinta- ja tuottovertailu, henkilökohtainen lista sopivista kohteista ja seuraavan vaiheen aikataulu.

👉 Kysy nyt tai tilaa markkinapäivityksemme saadaksesi kuukausittaiset tiedot Turkin kiinteistöistä.

(Tämä artikkeli perustuu uusimpaan markkina-analyysiin ja keskuspankin tietoihin Turkin asuntomarkkinoista, vuoden 2025 toinen–kolmas neljännes).