Ennätyksellinen Turkin kiinteistömarkkinoiden kasvu tammi-marraskuussa vuonna 2025

Turkin kiinteistösektori saavutti ennätyksellisen vahvimman tuloksensa tammi-marraskuussa. Ennätyksellinen Turkin kiinteistömarkkinoiden kasvu syntyi kun noin 2,87 miljoonaa kiinteistöä myytiin vuoden 2025 ensimmäisten 11 kuukauden aikana. Tämä edustaa vankkaa 7,6 prosentin kasvua edellisvuoteen verrattuna, ja sitä vauhdittivat vahva kotimainen kysyntä, lisääntynyt transaktiotoiminta ja sijoittajien terve kiinnostus sekä asuin- että liikekiinteistöissä. Transaktiomäärät kansallisessa rekisterissä nousivat yli 18 miljoonaan merkintään, mukaan lukien myynnit, kiinnitykset, siirrot ja niihin liittyvät hallinnolliset toiminnot. Erityisesti rekisterimaksutulot kasvoivat merkittävästi, mikä heijastaa kiinteistöjen arvojen nousua ja markkinoiden likviditeetin säilymistä.

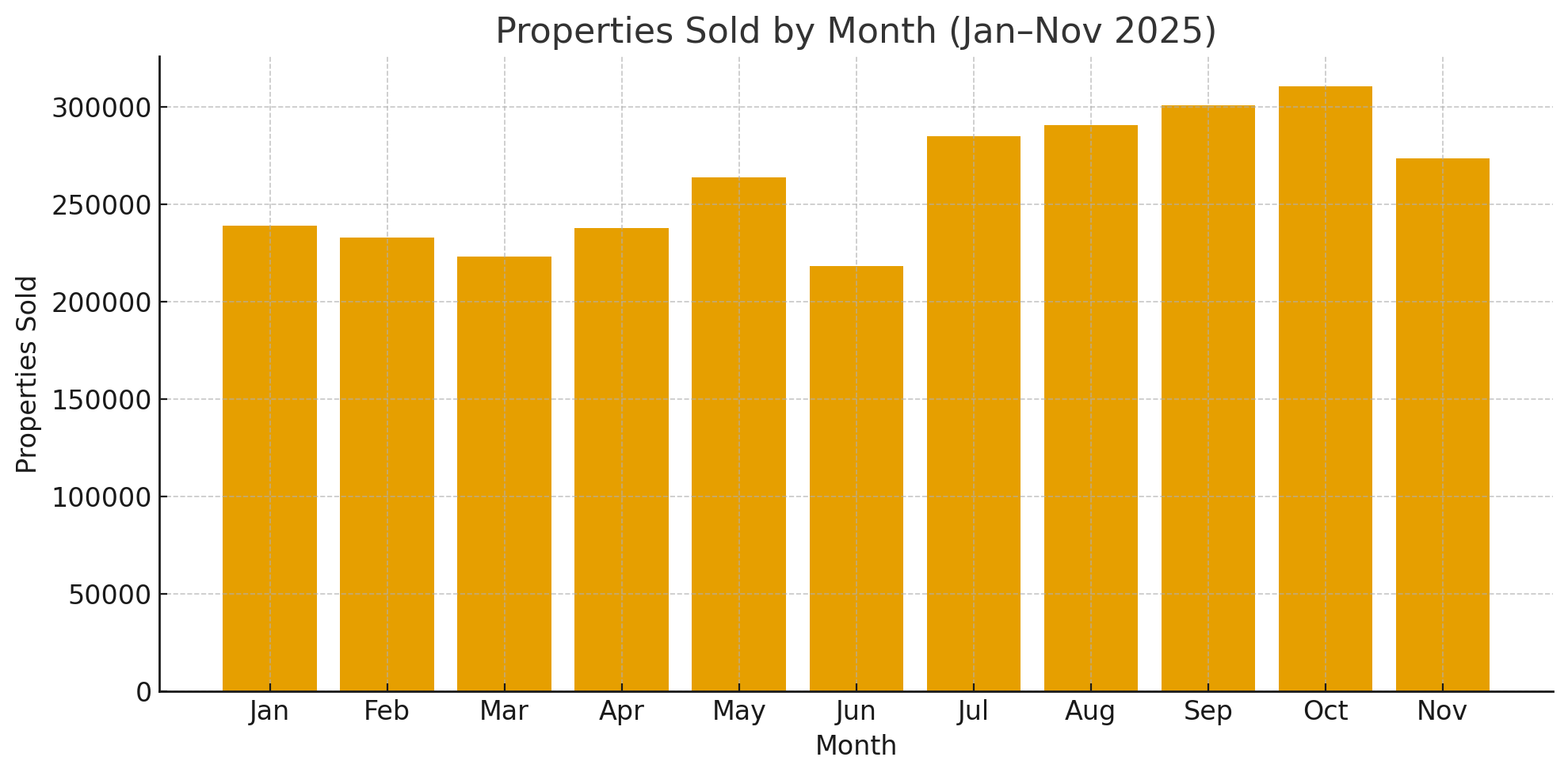

Kuukausittainen myyntikatsaus (tammi-marraskuu 2025)

Seuraava tietojoukko heijastaa kuukausittaisia kiinteistökauppoja Turkissa ja havainnollistaa kausivaihteluita ja markkinoiden huippuaikoja, joita sijoittajat ja myyjät usein käyttävät ajoituksen optimointiin.

Taulukko – Myydyt kiinteistöt kuukausittain

(Tammi-marraskuu 2025)

| Kuukausi | Myydyt kiinteistöt |

|---|---|

| Tammi | 238,938 |

| Helmi | 232,756 |

| Maalis | 222,934 |

| Huhti | 237,829 |

| Touko | 263,643 |

| Kesä | 218,282 |

| Heinä | 284,852 |

| Elo | 290,564 |

| Syys | 300,687 |

| Loka | 310,457 |

| Marras | 273,295 |

Kuukausittaiset kiinteistömyynnit

This chart clearly shows a steady rise in activity from mid-year, peaking in August through October, with October marking the highest sales volume.

What These Trends Mean for the Market

Strong Domestic and Investor Demand

Consistent sales growth demonstrates durable interest from both households and investors. High transaction volumes in mid-year months reflect active mortgage utilization, favourable buying conditions, and portfolio diversification trends.

Seasonal Opportunity Windows

Property sales typically accelerate between July and October, offering:

- Ideal conditions for sellers to list properties with higher exposure

- Improved selection and negotiation leverage for buyers

- Increased liquidity for investors targeting quick turnover assets

Value Signals from Transaction Revenues

A substantial rise in registry fee revenues indicates:

- Higher property valuations

- Increased transaction values

- Greater participation in secondary market activity

This trend benefits sellers and long-term investors aiming to capitalise on capital appreciation.

Strategic Insights for Buyers, Sellers, and Investors

Buyers

- Monitor monthly sales cycles to identify periods with larger inventory.

- Engage mortgage institutions early to secure favourable terms.

- Target post-summer months for broader property options.

Sellers

- Leverage high-demand seasons (Jul–Oct) for competitive pricing.

- Enhance listing readiness with documentation and valuation accuracy.

- Focus on digital exposure to access active domestic and foreign buyers.

Investors

- Use monthly transaction trends to time acquisitions and disposals.

- Diversify across asset types—residential, land, and commercial.

- Track fee revenue and transaction volumes as market performance indicators.

Risks and Market Considerations

Even in a growth environment, stakeholders should remain aware of several important factors:

Interest Rate Sensitivity

Mortgage activity forms a significant portion of sales performance. Sudden rate changes can affect buyer affordability and transaction velocity.

Regional Market Differences

While national figures are strong, performance varies by province. Major urban hubs dominate activity, but secondary cities show emerging growth pathways.

Administrative Throughput

During peak months, registry offices may experience processing delays. Pre-clearing documents and engaging experienced intermediaries helps prevent disruptions.

Ideal Estates: Expert Support in a Record-Breaking Market

Ideal Estates provides strategic guidance to help you navigate Turkey’s evolving property landscape. Whether you are buying, selling, or investing, our specialists offer data-driven insights, accurate valuations, and end-to-end transactional support.

Take advantage of Turkey’s record-setting real estate momentum.

Contact Ideal Estates today for a personalised market consultation, detailed valuation, or investor opportunity review.

Subscribe to our insights newsletter to receive monthly charts, market updates, and investment guidance.

Frequently Asked Questions About Record Turkish Real Estate Growth

1. Why were property sales so high in 2025?

Strong domestic demand, active mortgage utilization, and favourable seasonal dynamics contributed to elevated sales across major markets.

2. Which months saw the strongest property sales?

The most active months were July through October, with October delivering the highest monthly sales.

3. Do these figures include all types of property?

Yes, the data includes residential, commercial, land, and other real estate categories.

4. Is the Turkish real estate market attractive for foreign investors?

Yes. Consistent transaction growth, rising values, and favourable long-term fundamentals make Turkey appealing to international buyers.

5. What is the best time of year to buy or sell?

Mid- to late-summer through autumn typically offers the most activity, benefiting both buyers (more choice) and sellers (higher demand).