📈 Turkey’s Q2 Growth Boosts Property Demand: Executive Summary – Why Q2 Matters for Real Estate

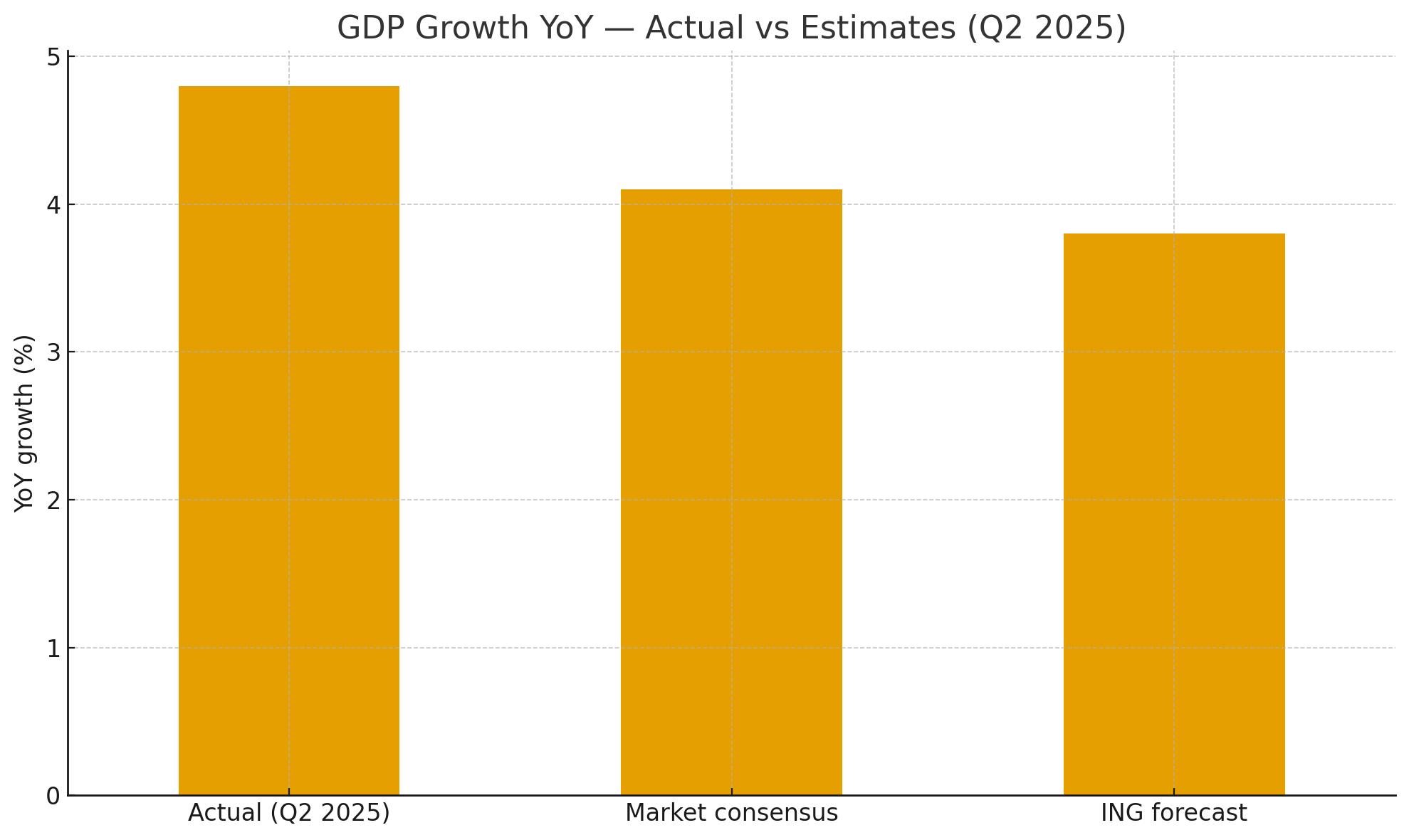

Turkey’s Q2 Growth Boosts Property Demand as the economy surprised on the upside in the second quarter of 2025—an outcome with direct implications for buyer demand, rental performance, construction activity, and financing. Annual GDP growth accelerated to 4.8% YoY while seasonally adjusted output rose 1.6% QoQ, the fastest quarterly pace in two years. Growth was propelled by private consumption and a strong investment rebound—especially in construction—even as net exports weighed on the headline figure. ING also nudged its 2025 GDP forecast up to 3.3%, underscoring a sturdier-than-expected backdrop for housing and real assets. ING Think

Tip for investors: stronger macro momentum typically correlates with healthier absorption of new units, firmer rental demand, and deeper buyer pools—especially in employment-rich, service-oriented cities.

🧭 How to Read the Charts and Table Above

- Key Macro Snapshot (table): Quick view of actual GDP vs. consensus and earlier forecasts, the quarter-on-quarter impulse, plus revision details.

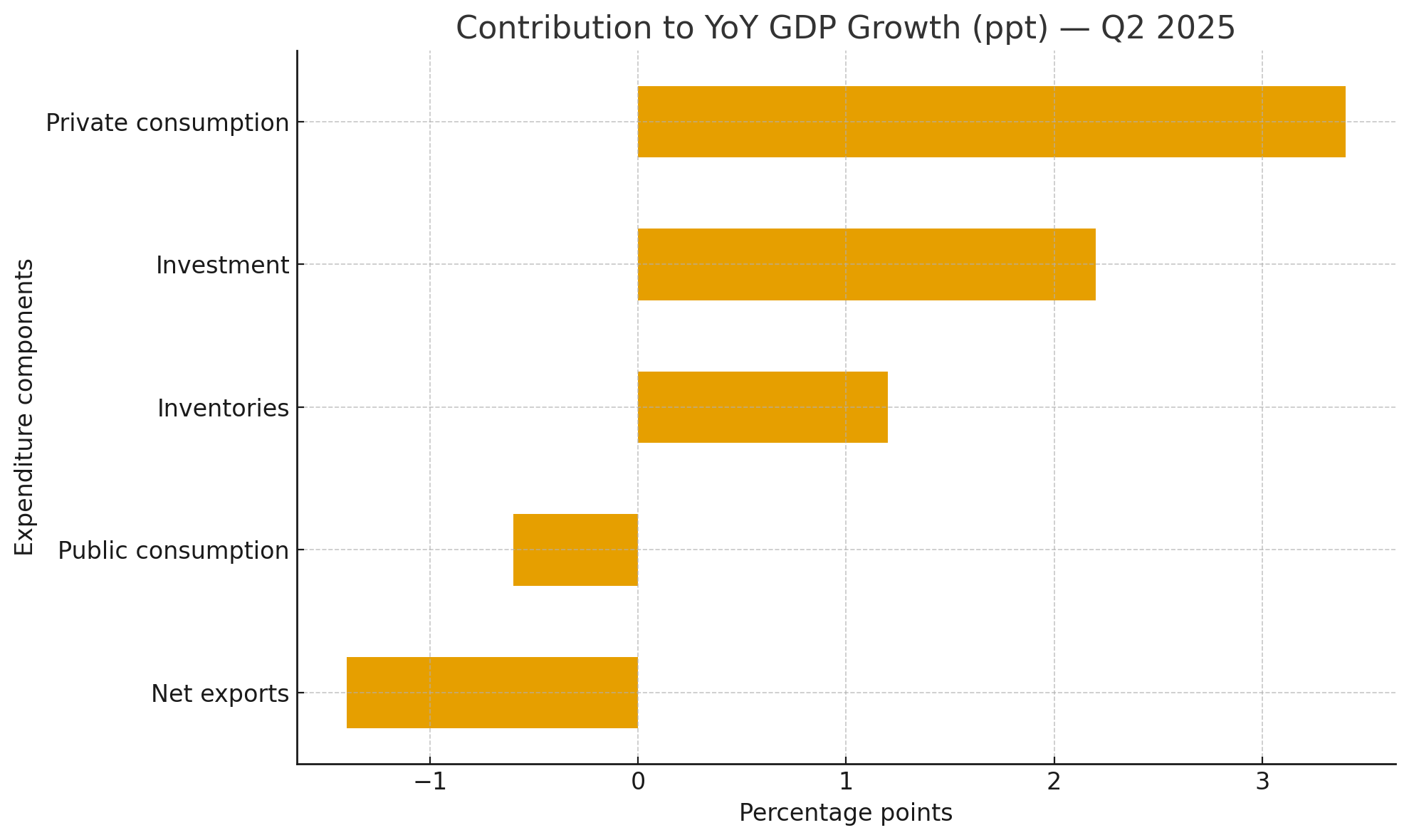

- Contribution to Growth (bar chart): Shows which demand components moved the needle—private consumption, investment, inventories, public spending, and net exports.

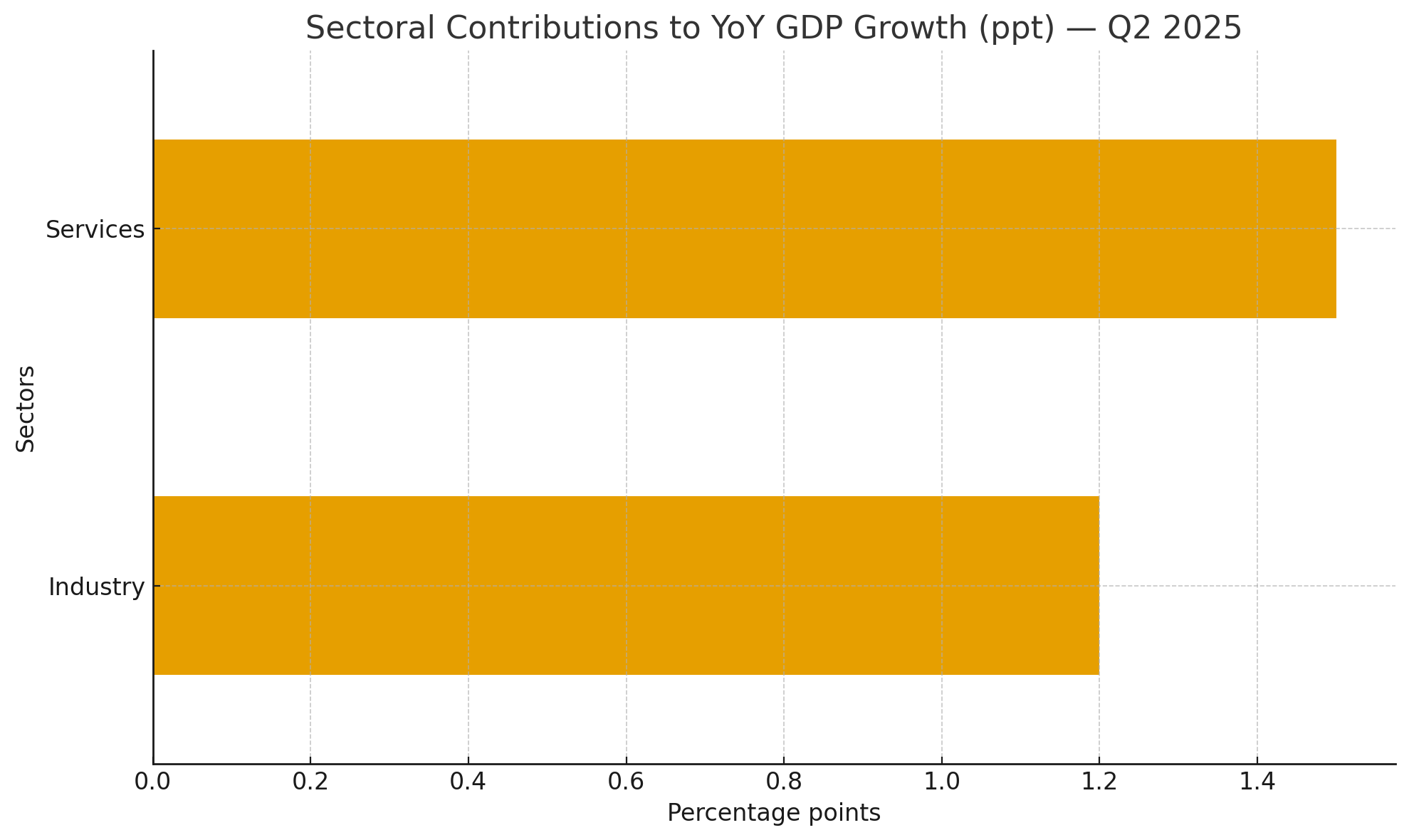

- Sectoral Contributions (bar chart): Services and industry led overall performance, a constructive mix for urban residential and mixed-use markets.

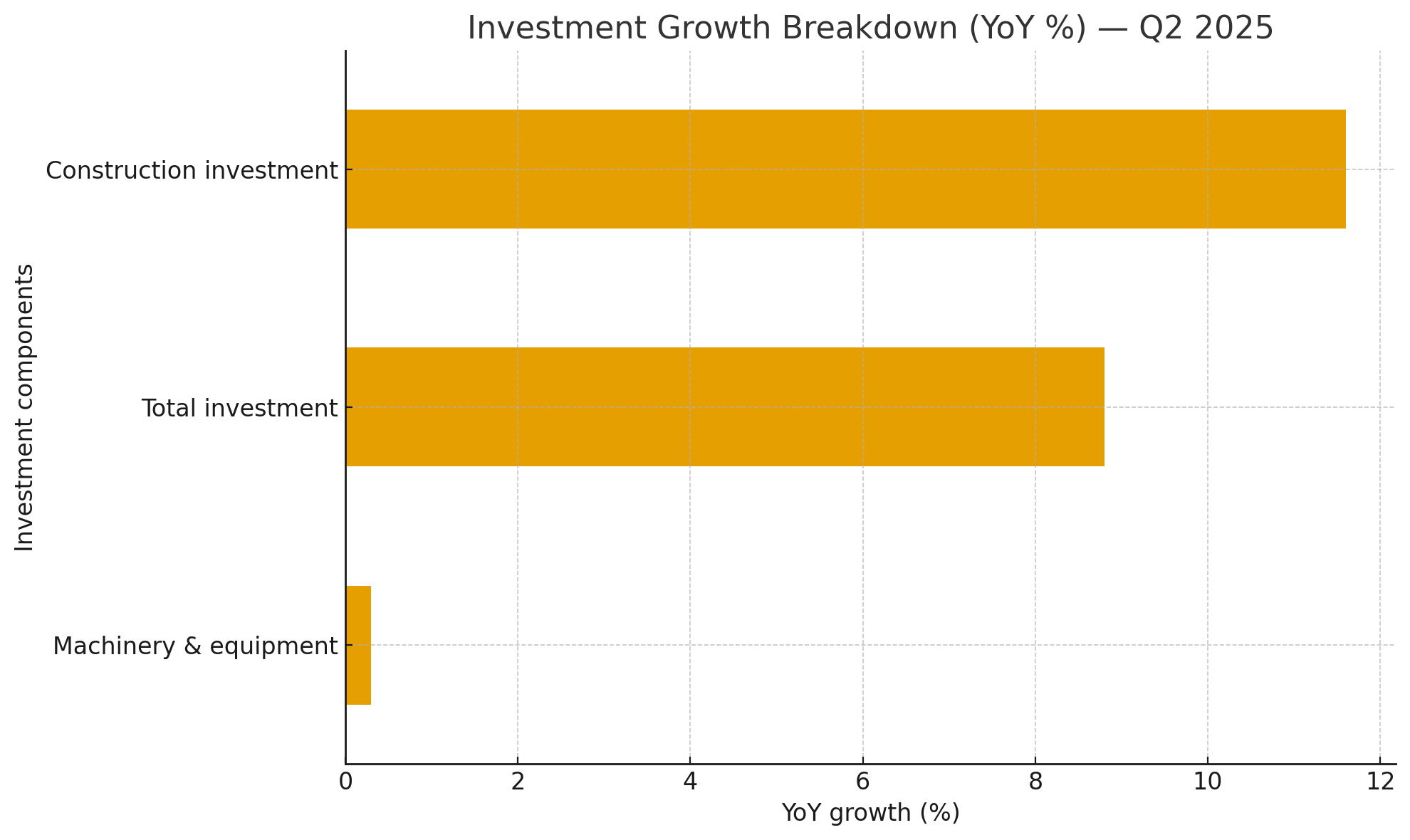

- Investment Growth Breakdown (bar chart): Construction investment outpaced overall capex, signaling a livelier development pipeline.

🏡 What Stronger Growth Means for Housing

🔎 Demand Pulse: Households Are Still Spending

- Private consumption rose 5.1% YoY, adding 3.4ppt to growth. For property, that often translates into:

- More owner-occupier upgrades (e.g., trading up for space, amenities, or better school districts).

- Firmer rental demand, especially in job hubs and university corridors.

- Retail and mixed-use resilience in neighborhoods with strong footfall.

🏗️ Supply Pipeline: Construction Picks Up

- Investment advanced 8.8% YoY (adding 2.2ppt), led by construction investment up 11.6%; machinery & equipment edged +0.3%.

- Expect:

- More new-build launches and off-plan opportunities.

- Potentially longer delivery pipelines as developers respond to demand.

- A quality upgrade cycle (energy efficiency, building tech, and community amenities).

🧰 Government & Net Trade: The Offsets to Watch

- Public consumption fell 5.2% YoY (–0.6ppt), while net exports detracted –1.4ppt amid rising imports.

- Practical takeaway: the domestic engine is doing the heavy lifting; investors should favor locations with diversified local demand rather than relying solely on external flows.

🧪 Sector Mix: Services + Industry = Urban Tailwinds

- Services contributed +1.5ppt and industry +1.2ppt to growth, hinting at healthy employment corridors—a backbone for steady rental absorption and end-user demand. Look to submarkets near office clusters, hospitals, logistics nodes, and transport interchanges that benefit from this mix.

💶 Financing, Rates, and Affordability

While economic momentum is constructive, policy makers may proceed cautiously on rate cuts given the strength of domestic demand. That means funding costs could improve gradually, not all at once. For buyers and developers:

- Mortgage shoppers: lock when rates fit your budget, but keep optionality (e.g., rate switches if lenders offer them later).

- Developers: consider phased launches and staggered payment plans to widen eligibility and maintain absorption.

- Investors: stress-test yields under flat-to-slightly-lower rate scenarios, not aggressive easing.

🗺️ Where the Opportunities Cluster

Istanbul & Greater Marmara

- Deep, diversified services economy—finance, tech, media—supports rental liquidity and resale depth.

- Transit-oriented and regeneration districts often deliver the best risk-adjusted profiles.

Antalya & Coastal Hubs

- Enduring tourism flows and second-home demand underpin short-term rental income, while upgraded infrastructure broadens year-round appeal.

Ankara & Izmir

- Public sector, education, and industry drivers balance demand. Family-oriented neighborhoods with good schools and parks see stable occupancy.

Buyer note: prioritize units with energy efficiency, good daylight, and flexible layouts—attributes that hold value across cycles.

📊 Reading the Q2 Numbers for Strategy

1) Entry Timing

- With QoQ growth at 1.6%—the best in two years—momentum is positive. Consider pre-completion allocations in credible projects to capture early-pricing and customization options.

2) Product Mix

- Given construction outperformance, supply will rise in selected corridors. Focus on differentiated inventory:

- Corner layouts, terraces, duplexes with views.

- Buildings with EV-ready parking, smart home systems, and efficient HVAC.

3) Yield Management

- In service-led districts, pursue dual-market strategies:

- Long-let stability near corporate and health clusters.

- Seasonal flex in tourist-adjacent areas to lift blended yields.

4) Risk Controls

- Hedge currency exposure where relevant, maintain contingency buffers, and test exits via comparable resale evidence.

🧩 The Macro-to-Micro Bridge (for Real Investors)

- Macro Growth (4.8% YoY; 1.6% QoQ) → Labor Market Support → Household Formation → Housing Demand

- Investment Surge (esp. construction) → New Supply → More Choice, Price Dispersion → Value in Better Specs & Locations

- Cautious Policy Easing → Funding Costs Improve Slowly → Prioritize Cash-Flow Resilience

🛠️ How Ideal Estates Helps You Act on This

Data-Led Market Scans

We translate macro releases into micro-level site evaluations, using absorption trends, price-per-square-metre histories, and rental comps to benchmark every shortlist.

Deal Origination & Vetting

From pre-launch allocations to off-market resales, our team filters for developer track record, escrow/guarantees, construction milestones, and title clarity.

Financing Pathways

We connect you with lenders and brokers offering competitive terms, explain eligibility, and model true cost of capital (including fees, insurance, and prepayment terms).

End-to-End Execution

One team handles negotiation, tax and closing coordination, snagging, and handover—followed by lettings & management to stabilize income quickly.

⭐ WHY PARTNER WITH IDEAL ESTATES

- Local Intelligence, Global Standards 🧭 — On-the-ground insight with institutional-level diligence.

- Developer Access 🔑 — Early-stage allocations and incentives you won’t see on portals.

- Risk Management 🛡️ — Scenario testing, exit analysis, and compliance screening as default.

- Design & Spec Advisory 🧩 — We help you choose units that rent and resell better (light, layout, acoustics, storage).

- Aftercare That Matters 🤝 — Lettings, furnishing, and asset performance dashboards—so you track NOI, not just rent.

🔍 Q2 2025: Key Facts Recap (with visuals)

- GDP +4.8% YoY (vs. 4.1% consensus; 3.8% ING forecast).

- QoQ SA +1.6%, strongest in two years.

- Private consumption +5.1% YoY (contrib. +3.4ppt).

- Investment +8.8% YoY (contrib. +2.2ppt), with construction +11.6% and machinery & equipment +0.3%.

- Public consumption –5.2% YoY (–0.6ppt), inventories +1.2ppt, net exports –1.4ppt.

- Services +1.5ppt, industry +1.2ppt to growth.

- 2025 growth forecast raised to 3.3%.

📌 Investor Playbook for the Next 6–12 Months

Focus Areas

- Transit-served projects near job nodes (metro lines, hospitals, business parks).

- Energy-efficient buildings targeting lower running costs and stronger tenant appeal.

- Mixed-use communities with retail and public realm—higher stickiness, fewer vacancies.

Acquisition Tactics

- Combine ready-to-move (cash-flow now) with off-plan (equity growth on completion).

- Negotiate flexible stage payments; secure furniture and appliance packages to accelerate leasing.

- Use tenant profiling (students, medical staff, young families) to match unit types to local demand.

Portfolio Risk Controls

- Cap single-asset exposure; diversify across city zones and tenant profiles.

- Build a 3–6 month reserve for each unit.

- Audit insurance, service charges, and HOA rules before signing.

📞 Work With Ideal Estates

Whether you’re a first-time buyer or a seasoned fund, our specialists can convert the macro tailwinds of Q2 into actionable, property-specific strategies—from site tours to contracts, finance, and turnkey letting.

CTA: Ready to capitalise on Turkey’s momentum? Contact Ideal Estates to request a personalized market brief, explore vetted projects, or subscribe to our monthly investor updates.

❓FAQs About Turkey’s Q2 Growth Boosts Property Demand

Q1: Is now a good time to buy?

Yes—momentum is supportive, and construction investment is rising, creating more quality options. Focus on location, build quality, and cash-flow to protect downside.

Q2: Where are the strongest rental prospects?

Service- and industry-rich districts near transport, hospitals, and business parks typically show the most resilient tenant demand and occupancy—a theme reinforced by Q2’s sector mix.

Q3: How will rates affect my mortgage?

Policy makers may ease cautiously. Plan for gradual improvements in financing rather than sharp drops. Choose products with refi flexibility where possible.

Q4: Does more construction mean prices fall?

Not necessarily. More supply increases choice and spec differentiation; the best-located, energy-efficient units with strong amenities often keep pricing power even as pipelines expand.

Q5: Off-plan or completed units?

Blend both. Off-plan can capture early pricing and design choice; completed stock delivers immediate income. Your mix depends on risk tolerance and time horizon—Ideal Estates can model both for you.

Note: Figures, contributions, and revisions referenced above pertain to Q2 2025 GDP and related components as reported by ING (drawing on TurkStat data). They inform market context and are not investment advice. ING Think